Table of Contents

Key Takeaways

- With mobile searches accounting for over half of global searches, ensuring your lead forms are mobile-responsive is critical. Forms must be tested across different devices to verify readability, button accessibility, and proper screen formatting to prevent lead loss.

- Breaking lengthy forms into multiple steps can increase conversion rates by up to 86% compared to single-step forms.

How to Boost Your Lead Form Conversions

Most website visitors aren't ready to buy immediately, but they are eager to learn more. That's where lead forms become your secret weapon.

Lead forms are essential for conversions:

- Turn visitors into leads: Instead of losing visitors who leave your site, you now have a way to reach them directly

- Speed up your sales: When you know what prospects need, you can send them the right information at the right time

- Save time and effort: People who fill out your lead forms are genuinely interested, not just casual browsers. You can focus your energy on prospects who are more likely to become paying clients

- Never miss an opportunity: Connect your lead forms to your AMS system so you can follow up automatically. This way, no lead gets forgotten, and you can keep in touch until they're ready to buy

Lead forms are simple website tools that let visitors request information without the pressure to purchase. They capture contact details and specific needs, so you can follow up with helpful information tailored to their situation. This turns casual browsers into real prospects you can communicate with until they're ready to become clients.

Since most visitors need time to decide, lead forms give them an easy way to stay connected with you during their decision-making process. In this blog, uncover proven strategies to optimize your lead forms for maximum results.

Ready to Start Capturing & Converting Online Researchers?

Put a process behind your digital marketing presence by integrating your insurance website with a conversion-focused lead form, all using AgencyBloc solutions. Our insurance-specific solutions help your agency increase awareness, improve conversions, and streamline retention. Chat with an expert today to learn more about our digital marketing tools.

Schedule Your Demo Now

How to Calculate Conversion Rate on Lead Forms

You can calculate your lead form conversion rate using this formula:

(# of conversions / # of views) X 100

So, if 100 people viewed your lead form and 30 filled it out, for example, your conversion rate would be 30%.

Your lead form's placement, design, and messaging directly impact how many website visitors turn into leads.

Want to gather more leads this enrollment season with your website?

Discover how to attract, engage, and convert more visitors into qualified prospects.

Learn more

6 Ways You Can Double Your Lead Form Conversion Rate

1. Stick to Three (or Less!) Fields

A study conducted by HubSpot (opens in a new window) found that three fields or fewer were the optimal amount for conversion. For new visitors, stick to basics like:

- First and last name

- Email address

- Phone number

Use the follow-up conversation as a chance to gather more information about the prospect. A good rule of thumb to follow is this: what information is critical to help me take the next step? Usually, it’s just a name and contact information.

More data is great, but it can feel overwhelming and actually decrease your chances of conversion. Remember, people like fast and easy — if your lead form doesn’t fit those two criteria, you’re likely losing out on opportunities.

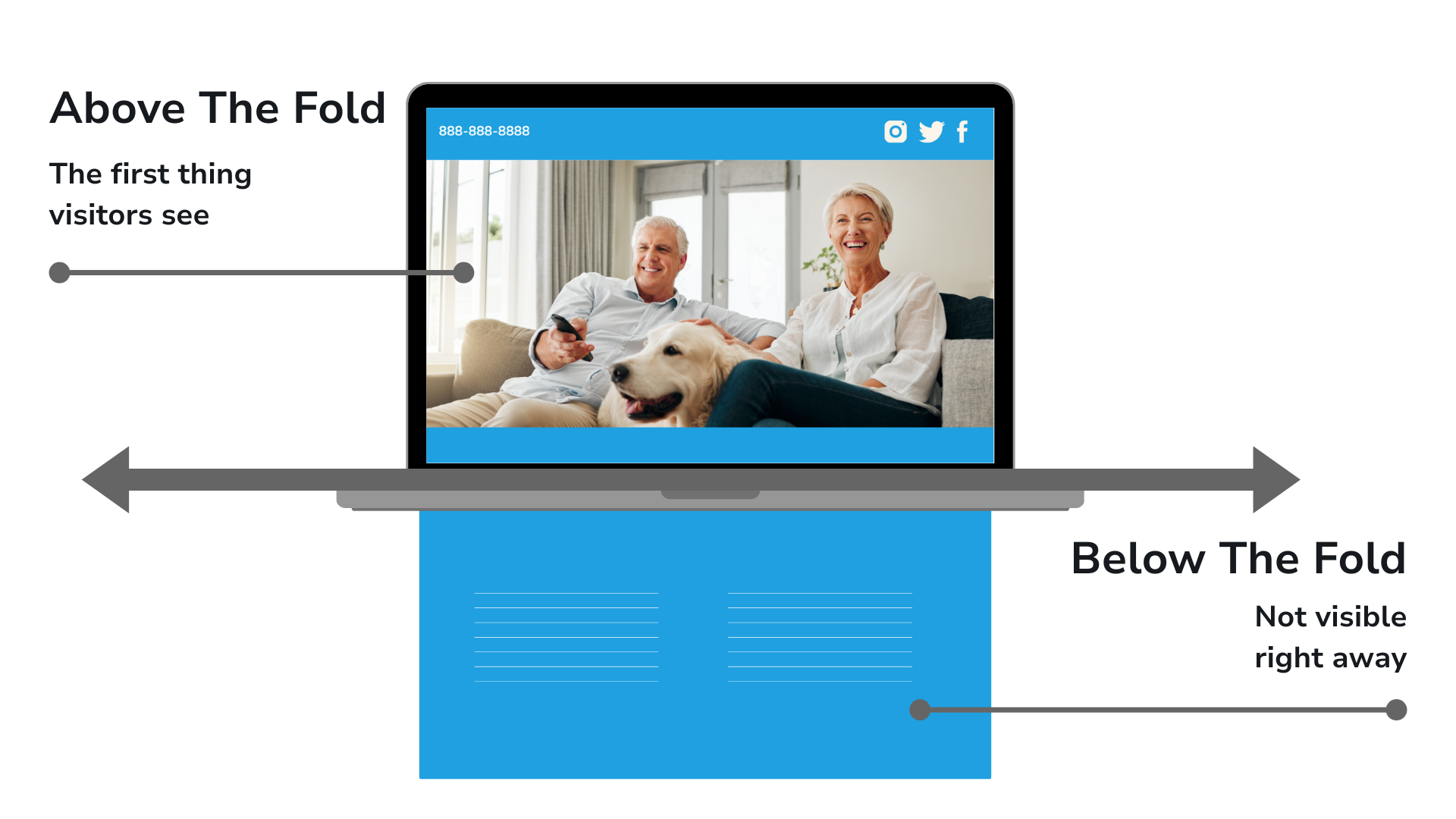

2. Position Forms Above the Fold

"Above the fold" is a web design term that refers to the portion of a webpage that's visible to visitors immediately when they land on the page, without having to scroll down. The easier your form is to find, the more people will fill it out.

Why placing lead forms above the fold of your insurance website matters:

- Immediate visibility: Visitors see your lead form right away

- Higher conversion rates: The more accessible your form, the more likely people are to complete it

- Simplifies the user journey: Save visitors from having to scroll and hunt for the form

Is Your Website Ready for Enrollment Season?

Your website is your digital front door. Ensure your insurance website is ready to help your agency streamline lead acquisition to make the sales process more efficient. Explore our professional, compliance-friendly insurance websites to help your team check all of the boxes without the headache.

3. Break Long Forms Into Steps

Instead of overwhelming users with one lengthy form, break it into multiple steps. Multi-step forms demonstrate an 86% higher conversion rate (opens in a new window) compared to single-step forms according to ivyforms.com. (opens in a new window) Users are much more likely to complete a form that feels quick and manageable, as multi-step forms feel less intimidating and keep users engaged throughout the process.

4. Offer Low-Commitment Options

Some people just aren't ready to provide their personal information right away. Using a low-commitment lead form option can keep website visitors interested who might otherwise leave your site. Low-commitment options you can include:

- Downloadable guide

- Newsletter opt-in

- Free Webinar

- On-demand video

This approach captures interested prospects who want more time to think things over before they reach out to your team, expanding your potential leads.

5. Ensure Your Lead Form is Mobile-Friendly

We’ve all been there. You visit a website, are interested in the product/service, and go to fill out the lead form, but it doesn’t reformat to fit on your phone. This situation isn’t just frustrating; it’s a potential lead leak for your funnel.

Mobile searches account for more than half of the global searches (opens in a new window) each year. It’s essential that both your website and lead form are set up to be mobile-friendly and responsive. If you’re not, you will lose prospects.

Test your lead form on different devices to make sure the text is readable, buttons are easy to tap, and the form fits the screen properly. This is what a responsive site would look like:

.png)

Smart lead form optimization transforms casual browsers into qualified prospects. When your forms are simple and well-designed, you'll create better user experiences and collect the information you need to follow up effectively.

Build a Lead Form With AMS+ Following These Steps

AgencyBloc’s AMS+ solution creates lead forms that automatically capture prospect information directly into your CRM. With built-in automation, you can collect insurance-specific details, trigger follow-ups, and manage leads — all in one platform, without manual entry or lost information.

How to build a lead form with AMS+:

- Create a custom form: Design a form to capture essential info like name, email, and phone, and embed it directly on your website

- Automate lead routing: Leads submitted through the form go straight into AMS+, automatically assigning them to the right agents based on criteria like location or lead source

- Connect workflows for nurturing: Once in AMS+, the lead can trigger automated tasks, notifications, and follow-up emails or texts to ensure timely and consistent communication

- Track & analyze: Segment leads and monitor performance, so your team can gain insights to optimize follow-ups and improve conversion rates

Once you've optimized your lead forms and started capturing more prospects, the next step is reaching out and communicating with those leads effectively.

Make Digital Marketing Easier with Engage+

Whether you need an insurance website, automated marketing tools, or expert guidance, we’re here to help. AgencyBloc’s Engage+ solution provides your agency with ready-to-use digital marketing tools and templates designed to help agents stay connected with their clients. It centralizes all of your efforts and makes it easy to create meaningful connections with your clients.

Ready to see how optimized lead forms can boost your conversions?

Schedule a live one-on-one demo today to see how the right lead form strategy can turn more visitors into qualified prospects.

Schedule a Demo

This blog was originally published on July 7, 2016, with updates on June 25, 2019, June 17, 2022, and September 19, 2025

Posted

by Shannon Beck

on Friday, September 19, 2025

in

Automated Lead Routing & Assignment

- data management

- lead nurturing

- selling

About The Author

Shannon is the Marketing Specialist at AgencyBloc. She creates and curates engaging, helpful content across blogs, social media, and other digital platforms for health, benefits, and senior insurance agencies looking to grow. Favorite quote: "If you can dream it, you can do it." &m

... read more