What's the Difference?

An Agency Management System vs. a Generic CRM: What's the Difference?

When comparing an insurance agency management system (AMS) with a generic CRM, there are three significant differences: who specifically it's built for, what features it includes, and how productive it makes you and your team.

Generic CRMs are built in a way that businesses of all sizes and industries can often utilize them. There are generic CRMs that are more geared for sizes of businesses, like small business, mid market, and large enterprises.

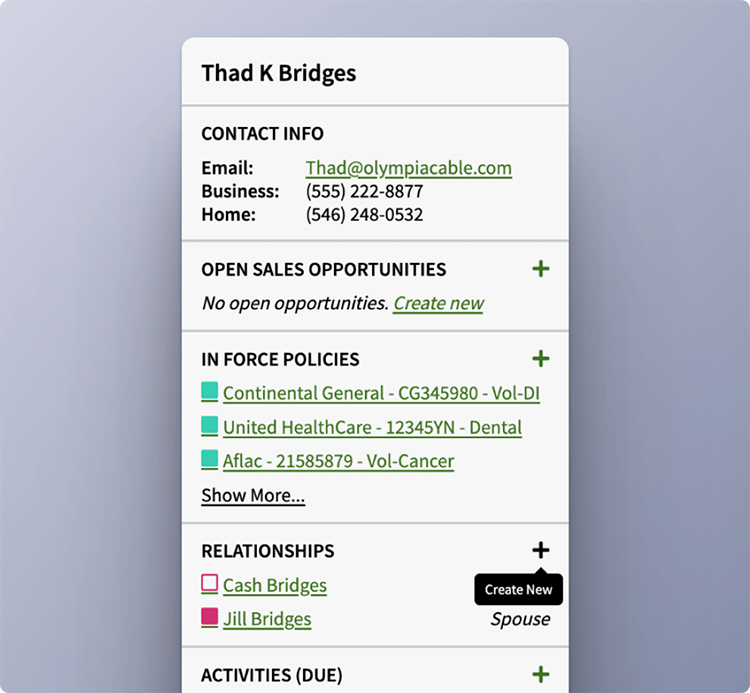

However, for insurance agencies to use CRMs effectively, they often need to build extensive customizations that can cost a significant amount of time and money. Many agencies have to seek out a developer or third party to assist in these customizations. Alternatively, an insurance-specific AMS includes important CRM capabilities, but is built for the specific needs of insurance agencies and includes specific field types (coverage types, policy details, etc.), policy management, contact type distinction (individuals vs. groups), sales and compliance management, and more.